Electricians keep San Antonio running — from lighting up new homes in Stone Oak to maintaining commercial wiring in downtown areas. But one small mistake or accident on the job can spark major costs. That’s why SOGO Insurance provides specialized electrician insurance designed for local contractors, independent tradesmen, and electrical businesses across Texas.

As a San Antonio-based independent agency, we understand how Texas weather, building codes, and jobsite conditions impact your daily work. Whether you’re wiring a new build in Alamo Heights or troubleshooting circuits after a storm, SOGO makes sure you have the right protection to keep your business powered up.

Contact Us

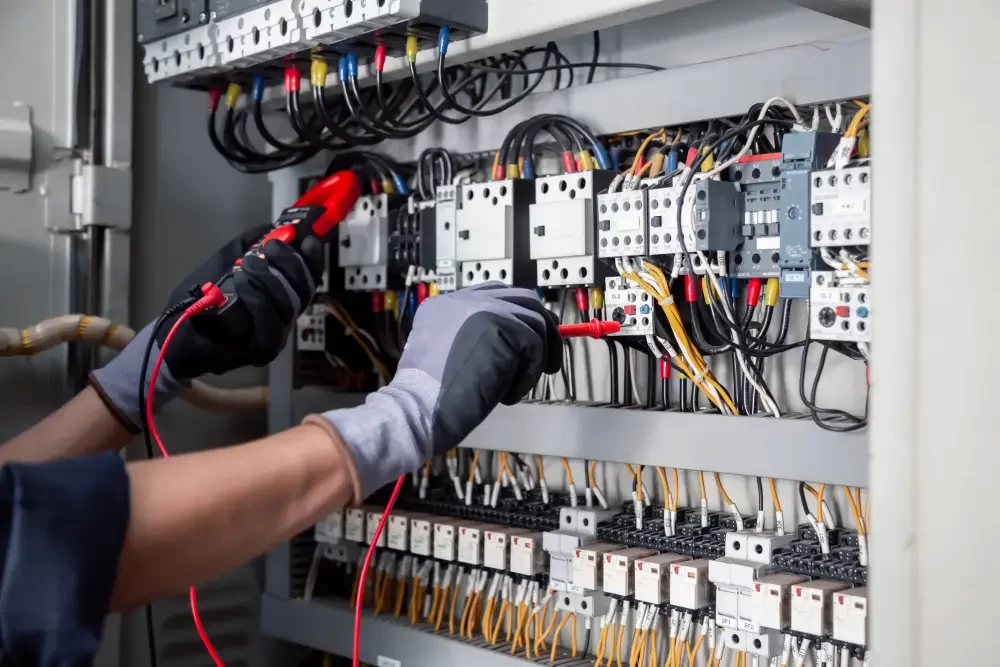

Electric work is high-risk — you handle live wires, climb ladders, and work around expensive equipment daily. The smallest error can lead to injuries, property damage, or costly legal claims.

Common electrician hazards include:

According to the Insurance Analytics Group, electrical accidents are a leading cause of construction-related injuries in Texas. With high humidity, flash storms, and constant outdoor work, San Antonio electricians face extra challenges, making reliable insurance more than just a checkbox for licensing.

You can’t do your job without your tools. This coverage protects expensive gear and equipment from theft, fire, or accidental damage, whether in your shop, truck, or at a jobsite.

If you employ staff, this coverage provides medical care and lost wages for on-the-job injuries. In Texas, workers' compensation is not mandatory, but many contractors carry it voluntarily to protect their employees and meet client requirements.

Even experienced electricians can make design or planning mistakes. E&O insurance helps with legal costs if you’re accused of faulty workmanship or negligent service.

Covers vehicles used for hauling tools, materials, and crew members between sites. Protects against collisions, property damage, and liability for trucks or vans used in your electrical business.

Protects against third-party bodily injury, property damage, and legal expenses. Example: If a client trips over wiring that you installed in a San Antonio home and gets injured, general liability covers medical bills and potential legal claims.

A cost-efficient package combining general liability and commercial property, sometimes with added business income coverage if your operations are interrupted by a covered event.

Electrician insurance premiums vary depending on business size, risk exposure, and claims history. According to The Allen Thomas Group, general liability coverage typically costs between $400 and $1,500 annually for small electrical businesses.

For example, a solo electrician in San Antonio may pay $500–$800 per year for basic general liability. A crew with multiple vehicles and employees could spend several thousand annually for broader coverage.

Your rate depends on:

In Texas, electricians are licensed through the Texas Department of Licensing & Regulation (TDLR). To maintain or renew your license and to win many commercial contracts, you may need to provide proof of insurance.

Requirements often include:

SOGO helps you meet these requirements by issuing certificates quickly and ensuring your coverage aligns with state and local standards.

As an independent broker, SOGO works for electricians, not insurance companies.

We compare multiple carriers to find affordable, comprehensive coverage that fits your trade and compliance needs.

Our local advantage:

We’ve helped countless Texas contractors secure insurance that keeps their businesses operating safely and confidently.