Insurance Market Trends: Stay Aware

Of all the industries affected by COVID-19, you might wonder how the insurance industry could be affected. How can a health crisis affect insurance types not related to health? Unfortunately, a domino effect has begun with people changing their old habits to new ones, and insurance premiums reflect those changes. In addition to the health […]

1099 vs. W2: Which One Is Right For Your Business?

Hiring employees at your small business is an exciting step towards growth and long-term financial success. It’s one of many signs of business health and is an excellent sign to investors that you’ve projected a sunny forecast from here on out. Aside from economic advantages, your work family is growing, creating a buzz in the […]

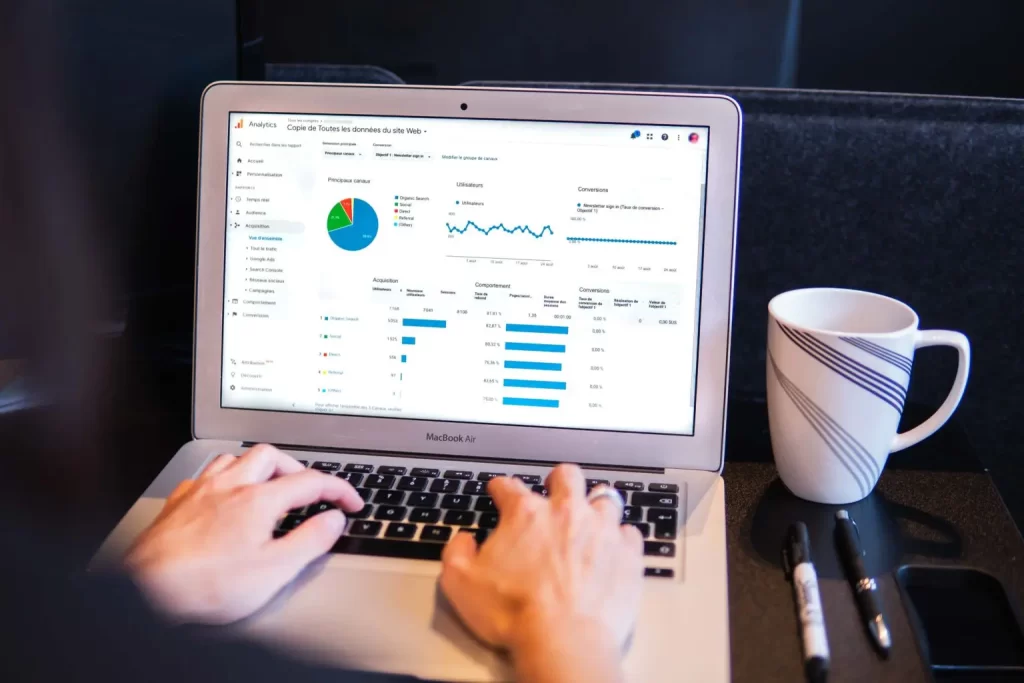

Do’s and Don’ts of Creating a Business Plan

So often, when browsing social media, websites, and streaming networks, we see advertisements for businesses or products and think, “Why didn’t I think of that?” Complete meal delivery services, monthly meat and produce subscriptions, and snack boxes with treats from foreign parts of the world. Even monthly dog toy deliveries are great examples of how […]

Employee Assistance Plans Make For Happy Employees

Texans are generally pretty happy-go-lucky people, gaining a reputation nationwide for being friendly folks, and that’s because we generally have a lot to be grateful for. Here, we value family, friendship, and the simple things in life, which makes us smile at any chance we can get. The city of San Antonio extends this notion […]

National Financial Awareness Day: 5 Ways to Improve Your Financial Wellness

It’s National Financial Awareness Day, and we’re here for it! SOGO Wealth & Risk Management has a knack for helping our clients manage their assets, so listen up as we brush up on these simple tips for the everyday adult to make steps toward improving your financial wellness. 1) Determine Your Net Worth – When was the last […]